Macondo And The Big “What If?”

BP’s report on what caused the explosion on the Deepwater Horizon has provoked a finger-pointing battle over who’s really to blame. But, none of this debate addresses what upsets people most about the crisis at the Macondo well. Beyond the human toll, beyond the economic and environmental damage, people are outraged that BP wasn’t prepared to respond.

To the public, it seems that no one at BP ever asked “what if?”

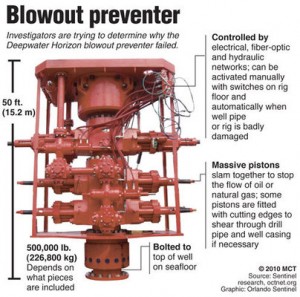

With Deepwater Horizon, BP put its crisis prevention faith in the blowout preventer. According to the Wall Street Journal, Lamar McKay, chairman and president of BP America, told a Senate panel on May 11th: “That was to be the failsafe in case of an accident.”

But many people look at images of blowout preventers and wonder why BP didn’t consider: “What if this thing fails?” Today, it seems obvious to outsiders with 20/20 hindsight that a lot could go wrong with such a complex piece of engineering. As a result, people believe that neither the company nor its regulators thought things through.

To be fair, a number of people at BP actually did raise the question. A 2007 paper co-authored by a BP engineer questioned whether blowout preventers would actually work to prevent deep water blowouts. Sadly, the What If question either wasn’t compelling to management or it wasn’t heard at all.

Blowout preventers were developed because people involved in offshore drilling asked “what if there’s a blowout?” But risk managers and crisis advisers can’t stop there. Once a new system, process, or piece of equipment gets installed, the protectors of companies have to take the question one step further: what if this new thing doesn’t work? And ultimately, good crisis advisers should help the company prepare for a scenario in which all the safeguards fail: What if the worst-case scenario happened? Would we be able to respond?

BP spokesman Andrew Gowers told the Wall Street Journal on June 29th that the company has put “significant effort and investment” into safety. After crises at Texas City and Prudhoe Bay and a near miss at Thunder Horse (among others), that’s what many Americans expected when Tony Hayward took over as CEO.

But there’s a difference between approaching safety as a series of standards to be met and creating a culture in which employees and executives compulsively ask What If and make decisions in the context of the answers.

What If questions are the bread and butter of the core protective functions in any company. These questions often deal with incredibly complex business issues, plant, and processes, and it requires a lot of experience and knowledge of the business to ask the questions effectively. In addition, the answers can have expensive ramifications, and operating executives adhering to budgets don’t like spending additional money.

But, a balance needs to be struck. The overall objective isn’t to limit the company’s ability to operate, and in fact, no level of investment can make a business completely safe and prepared. However, if a company doesn’t consider all the What If questions, there’s no way to know if its safety standards are appropriate or whether it’s operating in a risk environment that’s too dangerous.

At least, not until a crisis occurs. Then, the public will think all the answers to What If questions should have been obvious long ago.